SERVICE AREAS >> ARLINGTON

Virtual Bookkeeping for Arlington Service Businesses

Scalable Financial Management for the American Dream City

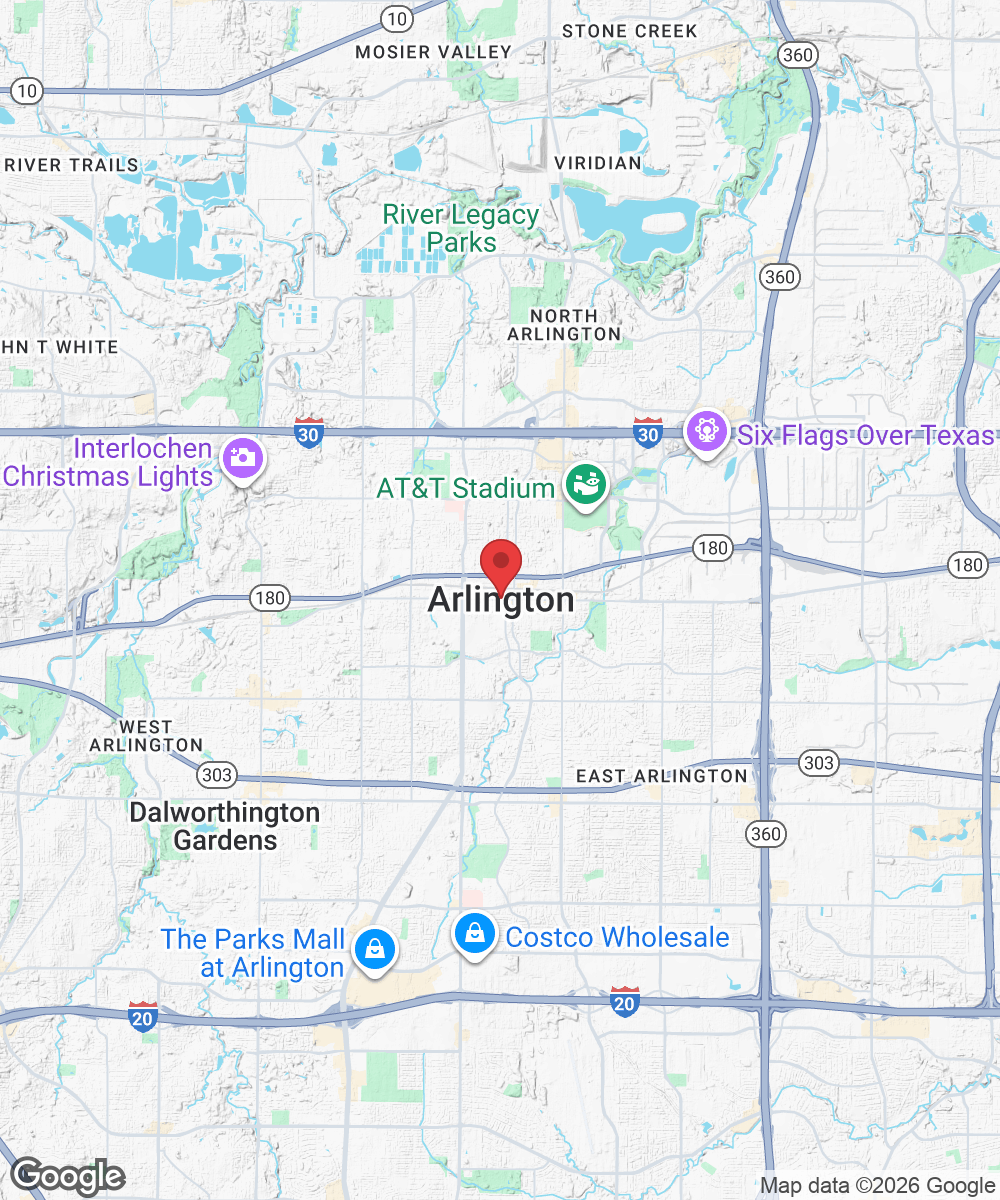

Located at the center of the DFW Metroplex, Arlington is a powerhouse of service-based innovation. From specialized engineering firms near UT Arlington to residential service contractors in Viridian, your business moves fast. We provide 100% online bookkeeping services tailored specifically for Texas-based service companies, giving you the financial clarity to compete in one of the state's most vibrant markets.

Expert Financial Bookkeeping Support for the Heart of North Texas

Arlington’s economy is a unique blend of entertainment, professional services, and trade industries. We understand the financial complexities of operating in Tarrant County:

Tarrant County & Texas Tax Compliance:We stay ahead of the 2025 Texas Franchise Taxrequirements. We monitor your revenue against the $2.47 million threshold to ensure your filings—including the Public Information Report—are accurate and on time.

High-Volume Service Tracking:Whether you run a landscaping company in Dalworthington Gardensor a medical consulting firm near the Entertainment District, we specialize in managing the high-volume transactions and billable hours common in the Arlington market.

Virtual Precision, Local Focus:You get the benefits of a modern cloud-based bookkeeping system with the peace of mind that your bookkeeper understands the Texas tax code and Arlington’s specific business landscape.

Neighborhoods & Business Hubs We Serve

Our virtual bookkeeping services are available to service-based leaders throughout the Arlington area:

Downtown Arlington & UTA District:Supporting tech startups, creative agencies, and professional services fueling the city's urban core.

North Arlington (Viridian & River Legacy):Expert financial management for high-end residential service providers and boutique consulting firms.

South Arlington (Highlands & Mansfield Border):Helping HVAC, plumbing, and electrical contractors manage cash flow as residential development

continues to surge.

The Entertainment District:Specialized bookkeeping for hospitality-adjacent services and event management companies.

2025 Online Bookkeeping Financial Solutions

We help Arlington service businesses leverage 2025 technology to stay lean and profitable:

Automated Expense Management:We integrate your business accounts with advanced AI-driven tools to categorize "Texas Sales and Use Tax" correctly, ensuring you never overpay or under-report.

Real-Time Profitability Dashboards:Track your margins while you’re at AT&T Stadiumor Globe Life Field. Our 100% virtual setup means your books are always updated and accessible from any device.

Audit-Ready Records:With the Texas Comptroller increasing digital audit capabilities in 2025, we ensure every receipt and invoice is digitally archived and mapped to the Texas Tax Code.

"Finding a bookkeeper who understands that a Texas service business isn't the same as a retail shop changed everything. Their virtual setup fits perfectly with my busy schedule in North Arlington."

Air BnB Owners

Track rental income, cleaning fees, and platform payouts accurately to maximize deductions and avoid tax pitfalls. Spend more time hosting guests and optimizing listings instead of chasing receipts and reconciliations.

Appliance Repair

Monitor parts inventory, service calls, and mileage expenses precisely for better job profitability. Focus on fixing appliances and growing your route without getting buried in financial paperwork.

Architects

Accurately record project fees, subcontractor costs, and software expenses for clearer profit per design. Dedicate your creativity to blueprints and clients rather than manual bookkeeping tasks.

Chiropractors

Track treatment revenue, supply expenses, and insurance reimbursements accurately to optimize cash flow. Reclaim hours from bookkeeping to concentrate on patient wellness and expanding your clinic.

Cleaning Services

Simplify job billing and equipment costs for scalable growth and predictable cash flow. Dedicate time to streak-free results and building routes rather than managing books.

Coaches

Simplify tracking high-ticket client invoices and business expenses for stress-free tax filing and clearer profits. Dedicate your energy to delivering value to clients rather than handling finances.

Contractors

Track job materials, labor, and change orders flawlessly to prevent cost overruns and ensure healthy margins. Prioritize bids, builds, and client satisfaction while keeping your books clean and tax-ready.

Course Creators

Simplify tracking course sales, platform fees, and marketing expenses for stress-free profitability insights. Focus on creating content and engaging students instead of juggling financial records.

Day Care Facilities

Manage tuition payments, supply costs, and staff payroll accurately for compliance and smooth operations. Spend your energy nurturing children and families rather than reconciling daily transactions.

Dentists

Ensure precise records of patient payments, equipment costs, and payroll for seamless tax compliance and profitability insights. Spend less time on books and more on patient care and practice growth..

Electricians

Record job invoices, wiring supplies, and vehicle costs precisely to optimize pricing and cash flow. Concentrate on safe installations and emergency calls without worrying about the books.

Engineers

rack consulting fees, project expenses, and continuing education costs reliably for maximized deductions. Invest time in innovative solutions and client projects instead of financial admin.

Graphic Designers

Monitor freelance invoices, software subscriptions, and stock asset costs accurately for clearer earnings. Focus on creative briefs and stunning designs rather than tracking every expense.

HVAC Sales & Repair

Manage seasonal revenue fluctuations and repair expenses with clean books for reliable cash flow forecasting. Invest more time in customer service and emergency calls instead of financial tracking.

Interior Designers

Accurately log client deposits, vendor purchases, and installation fees to avoid project overruns. Prioritize mood boards and transformations while ensuring profitable, organized finances.

Landlords of R/E

Track rent collections, maintenance expenses, and property costs seamlessly for easy tax reporting and vacancy planning. Focus on tenant relationships and property improvements instead of spreadsheet chaos.

Landscapers

Monitor seasonal contracts, equipment maintenance, and crew payroll for steady cash flow year-round. Focus on designs and client projects instead of seasonal financial chaos.

Massage Therapists

Simplify session revenue, supply costs, and continuing education tracking for predictable profits. Dedicate your healing touch to clients rather than managing receipts and reconciliations.

Optometrists

Monitor exam fees, frame inventory, and insurance reimbursements precisely for practice efficiency. Spend more time on patient eye care and prescriptions instead of financial tracking.

Painters

Track paint supplies, labor, and job estimates accurately to quote profitably and control overhead. Focus on flawless finishes and client wow-factor without bookkeeping distractions.

Personal Trainers

Monitor client packages and session revenue accurately for motivation in growing your roster. Focus on transformations and training instead of tracking payments and expenses.

Photographers

Manage session fees, editing costs, and travel expenses precisely for clearer project profitability. Invest time in shoots and creative work instead of tracking every receipt.

Plumbers

Track urgent job invoices, parts inventory, and vehicle costs precisely to prevent profit leaks. Focus on responding to calls and growing your service area without worrying about the books.

Real Estate Agents

Gain accurate tracking of commissions, expenses, and fluctuating income to maximize deductions and avoid tax surprises. Free up time from financial admin to focus on closing more deals and building client relationships.

Roofers

Accurately record job costs, materials, and subcontractor payments to control overhead and boost margins. Avoid bookkeeping headaches and prioritize winning bids and completing projects on time.

Beauty Salons

Track appointment income, product sales, and stylist commissions flawlessly for better inventory and staffing decisions. Devote your creativity to clients and salon growth, leaving finances to experts.

Therapists

Ensure confidential, accurate tracking of session fees and professional expenses for compliance peace of mind. Concentrate on client healing and practice growth rather than administrative finances.

Veterinarians

Track exam fees, medication inventory, and staff costs reliably for compliance and clinic efficiency. Focus on animal care and pet owners rather than reconciling daily transactions.

Videographers

Record shoot fees, equipment rentals, and editing costs precisely for project-by-project profitability. Invest your creativity in filming and storytelling instead of managing financial details.

Yoga Studios

Track class passes, instructor payroll, and studio supplies reliably for steady cash flow and growth. Focus on guiding mindful practices and community building while your books stay balanced.

Commonly Asked Questions

About Services.

Does it matter where my business is located?

Nope! I am Texas based and service individuals and businesses across the State of Texas. I focus on Texas businesses by leveraging the Internet to providing you the service you require.

What types of services does your firm offer?

I focus on small to medium sized companies that are service based.

We specialize in one thing: simple, flat-fee monthly bookkeeping for Texas service businesses that get paid on the spot.

That means mobile detailers, pressure washers, pool techs, painters, pest control routes, handymen, salons, pet groomers, photographers — anyone who:

1. Gets paid same-day or same-week (Square, Venmo, cash, Stripe)

2. Buys supplies but has no real inventory to count

3. Has no employees or just a couple 1099s

4. Wants clean, tax-ready books without the hassle

We give you a dedicated QuickBooks Ledger file + free Hubdoc receipt storage, categorize everything correctly (including COGS), reconcile monthly, handle Texas sales tax automatically, and deliver a one-page P&L plus everything your CPA needs at year-end — all for a flat $399/month.

No A/R chasing, no payroll, no bills to pay, no hourly surprises — just done-for-you books so you can go make money instead of messing with receipts.”

Do you charge setup or onboarding fees?

Typicallly NO, if your books are in order. If your business is more than a bank account and business credit card than we will discuss a small fee for time to setup. If you need "Cleaning Messy Books" a quote will be established after our interview conversation.

What reports do you provide me and my CPA?

Your ongoing reports, delivered around the 15th of the month, include a Balance Sheet and Income Statement or Profit & Loss Report. If you have taxable sales, a quarterly tax report is sent to you for filing. At the end of the year, you will have a franchise tax report, year end income & expense run sheet for your CPA for tax filing. Also if you have contract labor, 1099s will be available for you.

Richard the Texas Bookkeeper

Did not Find Your Questions?

I am here to help.

Book a quick call and let me answer any questions you may have.

BLOG ARTICLES

Our Collection of

Informative BlogPosts

Our FAQs are quick summary of our most commonly asked questions.

Follow the link below to look over our BLOG POSTS that go into more detail of bookkeeping and how our service may help your business.

Let's Talk: Schedule

Consultation Today!

Texas Bookkeeper saves me 6-8 hours per month doing bookkeeping, which translates to $10,800 to $14,400 of time a year, that I get back to focus on my business.

SUPPORT REQUEST - If you have any questions that need attention - CONTACT SUPPORT

Copyright 2023 - 2026. RWW Marketing LLC dba Texas Bookkeeper. All rights reserved.

Facebook

Instagram

LinkedIn

Website

Youtube